Transaction Advisory Services for Beginners

Wiki Article

Top Guidelines Of Transaction Advisory Services

Table of ContentsTransaction Advisory Services Fundamentals ExplainedTransaction Advisory Services Can Be Fun For AnyoneThe 9-Second Trick For Transaction Advisory Services8 Simple Techniques For Transaction Advisory ServicesAll About Transaction Advisory Services

This step makes certain the service looks its finest to potential purchasers. Getting the company's worth right is vital for an effective sale.Deal advisors step in to aid by obtaining all the needed info arranged, responding to concerns from customers, and organizing check outs to the business's location. This develops depend on with buyers and maintains the sale relocating along. Obtaining the best terms is crucial. Deal consultants utilize their know-how to help company owner take care of difficult arrangements, satisfy customer expectations, and framework offers that match the owner's objectives.

Satisfying lawful regulations is critical in any type of organization sale. They help company proprietors in preparing for their following actions, whether it's retired life, starting a brand-new venture, or managing their newfound wealth.

Purchase advisors bring a riches of experience and understanding, making sure that every aspect of the sale is handled expertly. Through calculated preparation, valuation, and negotiation, TAS helps company owner attain the highest possible price. By ensuring legal and governing compliance and managing due persistance alongside other deal staff member, purchase experts lessen potential risks and responsibilities.

The smart Trick of Transaction Advisory Services That Nobody is Discussing

By comparison, Big 4 TS groups: Work on (e.g., when a possible customer is carrying out due diligence, or when an offer is closing and the buyer requires to integrate the business and re-value the seller's Equilibrium Sheet). Are with fees that are not linked to the deal closing efficiently. Earn costs per interaction somewhere in the, which is less than what investment financial institutions gain even on "small bargains" (but the collection likelihood is likewise much greater).

The meeting inquiries are extremely similar to investment banking meeting concerns, however they'll focus extra on accounting and evaluation and less on topics like LBO modeling. As an example, anticipate inquiries about what the Modification in Working Resources ways, EBIT vs. EBITDA vs. Internet Earnings, and "accounting professional just" topics like trial equilibriums and exactly how to walk through events utilizing debits and credit scores instead of financial declaration changes.

The smart Trick of Transaction Advisory Services That Nobody is Talking About

that demonstrate just how both metrics have actually transformed based upon items, networks, and consumers. to judge the precision of monitoring's previous forecasts., including aging, inventory by product, ordinary degrees, and stipulations. to figure out whether they're original site entirely fictional or somewhat believable. Experts in the TS/ FDD groups may also interview administration regarding everything over, and they'll compose a detailed record with their searchings for at the end of the process., and the basic form looks like this: The entry-level duty, where you do a lot of information and monetary evaluation (2 years for a promo from below). The next level up; comparable work, but you get the more interesting bits (3 years for a promo).

Particularly, it's tough to get advertised beyond the Supervisor degree due to the fact that couple of individuals leave the task at that phase, and you require to start showing evidence of your capability to create earnings to advance. Let's begin with the hours and lifestyle because those are easier to explain:. There are periodic late evenings and weekend job, however nothing like the agitated nature of investment financial.

There are cost-of-living changes, so expect reduced compensation if you remain in a more affordable area outside major monetary facilities. For all placements other than Partner, the base pay comprises the mass of the total payment; the year-end bonus might be a max of 30% of your base wage. Often, the most effective method to increase your profits is to switch over to a various firm and work out for a higher income and bonus

The Of Transaction Advisory Services

You can get involved in business advancement, but financial investment financial obtains much more difficult at this stage since you'll be over-qualified for Analyst roles. Business financing is still an option. At this stage, you must simply remain and make a run for a Partner-level duty. If you wish to leave, possibly transfer to a client and perform their evaluations and due persistance in-house.The main problem is that because: You usually require to join an additional Large 4 group, such as audit, and job there for a few years and after that relocate into TS, job there for a couple of years and then Get the facts move into IB. And there's still no warranty of winning this IB function because it depends upon your area, customers, and the working with market at the time.

Longer-term, there is additionally some threat of and since evaluating a business's historical monetary info is not precisely rocket science. Yes, humans will certainly constantly require to be involved, but with more sophisticated technology, reduced head counts might possibly sustain client interactions. That said, the Deal Solutions team defeats audit in terms of pay, job, and leave opportunities.

If you liked this post, you may be curious about reading.

What Does Transaction Advisory Services Mean?

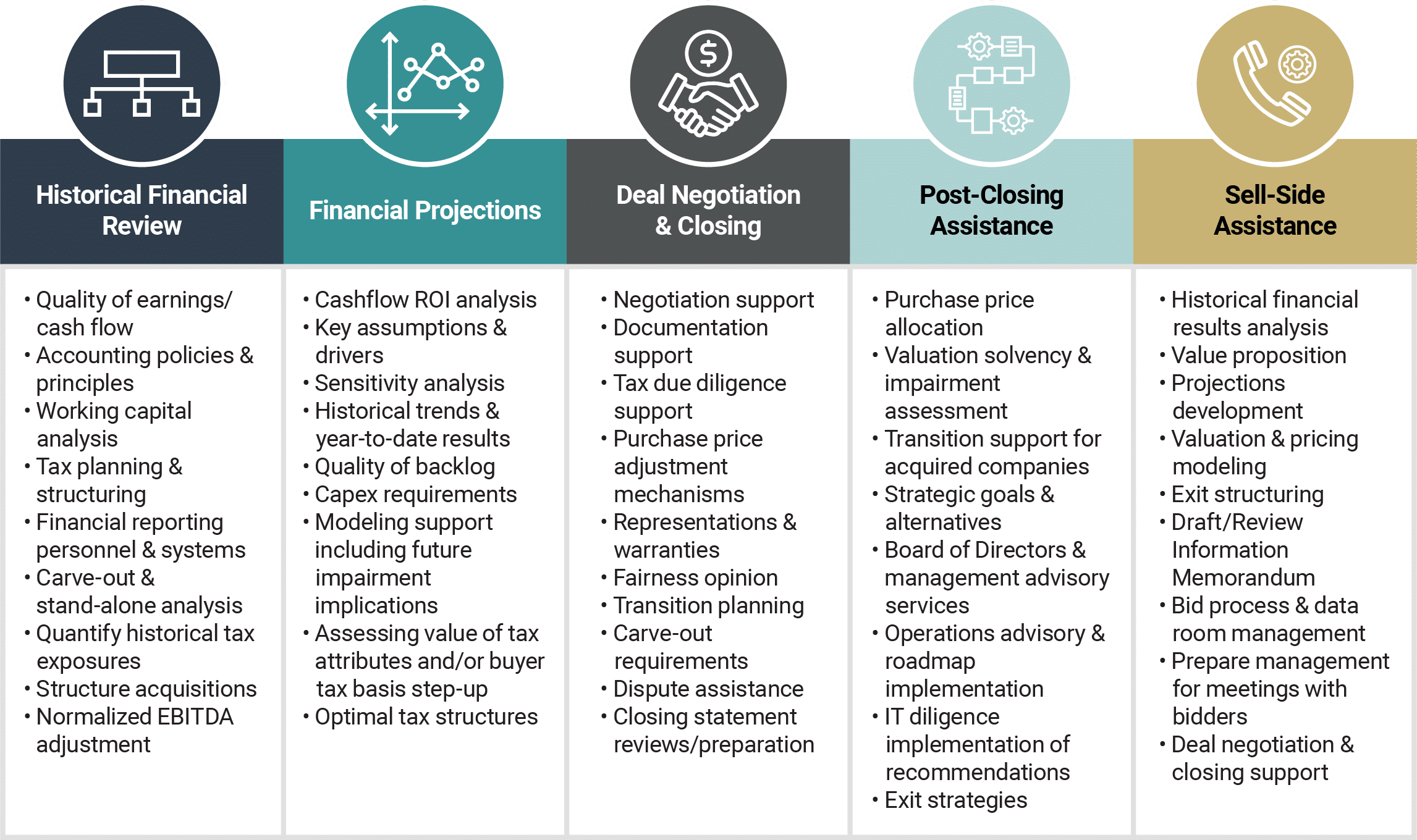

Develop innovative monetary structures that assist in identifying the real market price of a firm. Provide consultatory job in connection to organization assessment to aid in negotiating and pricing frameworks. Clarify one of the most ideal form of the offer and the kind of factor to consider to use (cash money, stock, earn out, and others).

Create action strategies for threat and direct exposure that have actually been identified. Do assimilation planning to determine the process, system, and business modifications that may be called for after the deal. Make numerical price quotes of integration prices and benefits to analyze the economic rationale of combination. Set standards for integrating departments, innovations, and organization procedures.

Analyze the prospective consumer base, market verticals, and sales cycle. The operational due diligence uses crucial understandings right into the functioning of the firm to be obtained concerning danger evaluation and my latest blog post value development.

Report this wiki page